TRX Price Prediction 2025-2040: Technical and Fundamental Outlook

#TRX

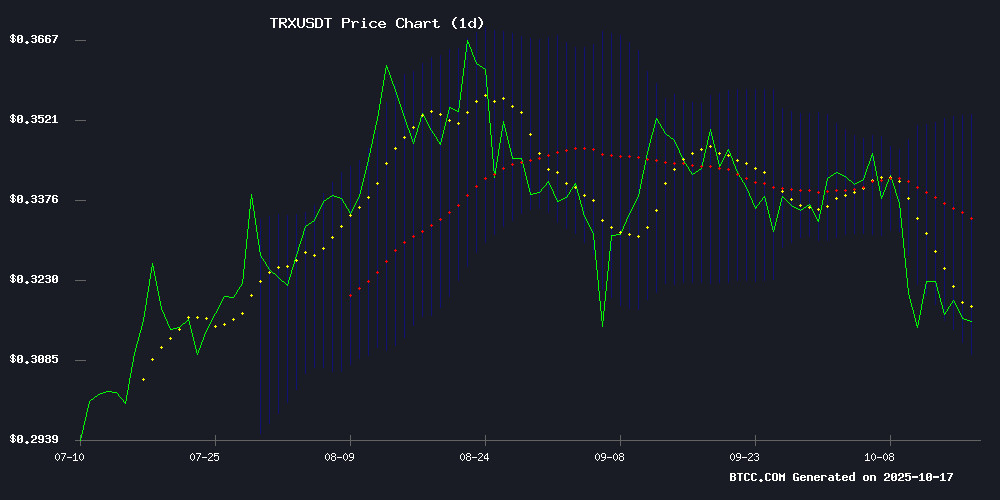

- Technical Positioning: TRX trading near lower Bollinger Band with bullish MACD divergence suggests potential rebound toward $0.33 resistance

- Market Catalysts: ETF developments and AI project interest provide positive momentum, while network actions and liquidations create near-term headwinds

- Long-term Trajectory: Gradual appreciation projected through 2040 driven by ecosystem development and broader crypto adoption trends

TRX Price Prediction

TRX Technical Analysis Shows Potential Rebound Ahead

According to BTCC financial analyst John, TRX is currently trading at $0.3072, below its 20-day moving average of $0.3308. The MACD indicator shows bullish momentum with the MACD line at 0.009939 above the signal line at 0.005363, generating a positive histogram of 0.004576. TRX is trading NEAR the lower Bollinger Band at $0.307541, suggesting potential oversold conditions. John notes that 'current technical positioning indicates TRX may be poised for a rebound toward the middle Bollinger Band at $0.3308 if bullish momentum sustains.'

Market Sentiment Mixed Amid ETF Expectations and Network Actions

BTCC financial analyst John comments that 'market sentiment appears divided as anticipation around new crypto ETFs and AI projects provides optimism, while Tether's freezing of $13.4 million USDT across ethereum and Tron networks and significant market liquidations create headwinds.' John emphasizes that 'these news developments align with our technical assessment of potential near-term volatility, though the ETF developments could provide longer-term support for TRX and the broader digital asset ecosystem.'

Factors Influencing TRX's Price

Crypto Market Anticipates New ETFs as DOGE and AI Projects Garner Attention

The crypto market is abuzz with anticipation as new exchange-traded funds loom on the horizon. Following the successful launches of Bitcoin and Ethereum ETFs, investors are now eyeing potential approvals for other major cryptocurrencies, including Solana, Cardano, Hedera, and Tron.

While established coins present opportunities for upside, emerging projects like DeepSnitch AI are capturing attention for their explosive potential. Combining artificial intelligence with crypto trading tailored for small traders, DeepSnitch AI is projected by some to achieve 300x growth post-launch.

Dogecoin enters the ETF arena with the debut of REX-Osprey's DOGE ETF (DOJE). Unlike spot ETFs that hold underlying assets, this synthetic ETF uses derivatives to track DOGE's price—offering indirect exposure rather than direct ownership of the meme cryptocurrency.

Tether Freezes $13.4M USDT Across Ethereum and Tron Networks

Tether has frozen 22 wallets holding $13.4 million worth of USDT on Ethereum and Tron networks. The largest freeze targeted a single Ethereum address containing $10.3 million, while a Tron wallet held $1.4 million. This action continues Tether's pattern of wallet freezes, including $12.3 million in June and $28.67 million in April 2025.

The stablecoin issuer has collaborated with 290 law enforcement agencies across 59 countries, freezing over $3.2 billion in criminal-linked USDT since September 2025. Blockchain analytics firm MistTrack reported the latest freeze, which brings Tether's total wallet blocks to approximately 3,660 over the past year.

Crypto Market Sees $1 Billion in Liquidations as Altcoins Plunge 12%

The cryptocurrency market faced another brutal sell-off on Thursday, with altcoins leading the decline. Bitcoin futures open interest held steady at $25 billion, but negative funding rates on Binance and OKX revealed traders are positioning for further downside. Meanwhile, the options market told a different story—the 1-week 25 Delta Skew surged to 12.6%, signaling growing demand for call options.

Altcoins bore the brunt of the selling pressure. TAO, ASTER, and LDO plummeted over 12%, while TRX eked out minor gains. Total liquidations hit $1 billion in 24 hours, with long positions accounting for 70% of the carnage. Ethereum led with $115 million in liquidations, followed by Bitcoin at $80 million.

The crypto rout mirrored weakness in traditional markets. The Dow Jones fell 300 points as regional bank concerns and U.S.-China trade tensions weighed on sentiment. This extended October's painful streak for digital assets, coming just days after $500 billion was wiped from crypto market valuations.

TRX Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical analysis and market fundamentals, BTCC financial analyst John provides the following TRX price projections:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $0.35 - $0.45 | Technical rebound, ETF developments, network adoption |

| 2030 | $0.80 - $1.20 | Mainnet upgrades, enterprise adoption, broader crypto market growth |

| 2035 | $1.50 - $2.50 | Mass adoption, interoperability solutions, regulatory clarity |

| 2040 | $3.00 - $5.00 | Mature ecosystem, global payment integration, technological advancements |

John cautions that 'these projections assume continued development of the Tron ecosystem and favorable regulatory conditions. Current technical indicators suggest near-term support around current levels with potential for gradual appreciation as market conditions stabilize.'